The Future of Finance and Cross-Border Payments: Why ISO 20022 Payment Systems Matter

- Loxicom

Categories: AI blockchain crypto crypto wallet dapps decentralization IT Services Company IT Support Loxicom web 3.0

By: Shawn Chambers

In the world of finance and cross-border payments, ISO 20022 payment systems are on the rise. This global standard for financial messaging gives institutions a common language to communicate with one another. In this article, we'll examine why ISO 20022 payment systems will remain influential into the future of finance and cross-border payments.

Optimized Efficiency

One major benefit of ISO 20022 payment systems is their capacity for efficiency. By creating a common language between financial institutions to communicate, these payment systems simplify payment processing and save time/resources required for reconciliation - saving financial institutions money while also increasing productivity levels.

Enhancing Data Quality

ISO 20022 payment systems offer enhanced data quality to increase accuracy and completeness of payment data. This can assist financial institutions reduce errors and discrepancies during payment processing, leading to fewer payment failures and higher customer satisfaction scores.

Global Standardization

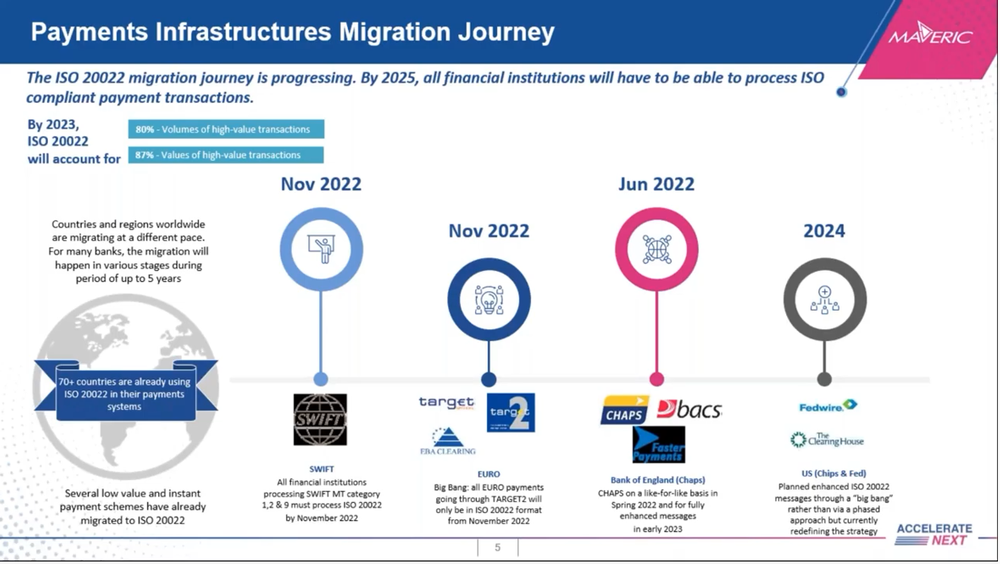

ISO 20022 payment systems are a globally accepted standard, meaning financial institutions around the world can utilize them to efficiently communicate with one another. This helps reduce friction during cross-border payments and makes doing business across borders much simpler for companies.

Support for New Payment Types

ISO 20022 payment systems are tailored to accommodate various payment methods, such as instant and mobile. This enables financial institutions to stay abreast of the most recent payment trends and meet their customers' ever-changing needs.

Regulatory Compliance

ISO 20022 payment systems offer enhanced regulatory compliance, as they provide a standard format for payment data that helps financial institutions meet various regulatory requirements. This helps reduce the risk of non-compliance and avoid expensive fines or penalties.

Finally, ISO 20022 payment systems are set to have a major impact on the future of finance and cross-border payments. By optimizing efficiency, data quality, providing global standardization, supporting new payment types, and adhering to regulatory compliance requirements, they offer financial institutions numerous advantages they cannot afford not to take advantage of. As this industry continues its journey forward, ISO 20022 payment systems will play an even more vital role in stimulating innovation and growth.